Mobile Checkout

Secure Mobile Payments

Solution Proposal

Solution Proposal

by Slava Gomzin

April 2009

1. Introduction

1.1 Purpose of Document

The purpose of this document is to define technological and business model of mobile payments solution.

1.2 General Concepts

The idea of mobile wallet is not new and few companies are already operating in this area. Modern communication technology and cryptographic techniques provide an ability to create reliable software solution using already existing hardware.

Some known mobile checkout implementations rely on technology called "Near Field Communications" (NFC) which is used for short-range wireless communication between mobile and POS devices. However, such technology requires special hardware on both mobile and POS device which makes this solution too complex and expensive for immediate mass implementation. Also, there are security issues – usually, the NFC-related technology means that credit card number is stored in mobile device and being transmitted to the POS device for every transaction attempt. Such approach makes NFC solution open for possible security flaws.

The alternative approach that can be taken is to minimize direct communication between mobile device and POS and make both mobile device and POS communicate via central server using Web Services and WAP technology. The payment can be processed by creating one-time virtual merchant’s website and using online mobile checkout flow which can be integrated with existing ecommerce solutions. The only communication required between POS and mobile device is scanning of the barcode with customer identification (one time token) displayed on mobile device. Such communication will use hardware which is regular for almost every merchant: POS scanner. If scanning is not possible for any reason, cashier can key the token number displayed on mobile device screen manually (the same way as manual credit card entry).

1.1 Purpose of Document

The purpose of this document is to define technological and business model of mobile payments solution.

1.2 General Concepts

The idea of mobile wallet is not new and few companies are already operating in this area. Modern communication technology and cryptographic techniques provide an ability to create reliable software solution using already existing hardware.

Some known mobile checkout implementations rely on technology called "Near Field Communications" (NFC) which is used for short-range wireless communication between mobile and POS devices. However, such technology requires special hardware on both mobile and POS device which makes this solution too complex and expensive for immediate mass implementation. Also, there are security issues – usually, the NFC-related technology means that credit card number is stored in mobile device and being transmitted to the POS device for every transaction attempt. Such approach makes NFC solution open for possible security flaws.

The alternative approach that can be taken is to minimize direct communication between mobile device and POS and make both mobile device and POS communicate via central server using Web Services and WAP technology. The payment can be processed by creating one-time virtual merchant’s website and using online mobile checkout flow which can be integrated with existing ecommerce solutions. The only communication required between POS and mobile device is scanning of the barcode with customer identification (one time token) displayed on mobile device. Such communication will use hardware which is regular for almost every merchant: POS scanner. If scanning is not possible for any reason, cashier can key the token number displayed on mobile device screen manually (the same way as manual credit card entry).

2. Solution

2.1 Basic Concepts

WEB-enabled mobile device (cell phone, smartphone) can be used as a new electronic payment method instead of traditional plastic cards. The customer creates online Mobile Checkout account and links it with payment processor account (like Amazon Payments). The customer can use the mobile device in order to pay for in-store transactions (grocery, c-store, gas stations) instead of using cash or plastics as well as online transactions or other “customer not present” transactions (phone orders, over the fax, online chat or email). At the checkout time, Mobile Checkout client application on mobile device will display a barcode with one-time token associated with the customer’s Mobile Checkout account. This token will be scanned or entered manually by cashier. Mobile Checkout POS client software will send the token number, merchant identification and transaction data to the server which will match the merchant and mobile device requests and reply to mobile device with a transaction details and prompt for payment authorization. Upon customer approval, the payment information will be forwarded by to the payment processor for authorization. Upon authorization, the result will be sent back to both POS and mobile device. POS will create transaction receipt and send it to the mobile device instead of printing. Mobile Checkout server will accumulate full transaction history and provide this information to both customer and merchant/retailer via Mobile Checkout portal website. There is no additional hardware required for retailer. Minimal changes in POS software code and configuration are required. Mobile Checkout creates flexible interactive payment instrument physically decoupled from the seller site (“brick and mortar” store, ecommerce website, virtual terminal, TV shopping, self-checkout kiosk, vending machine) while both seller and buyer are able to communicate each other in real time. This situation creates unlimited capabilities.

2.1 Basic Concepts

WEB-enabled mobile device (cell phone, smartphone) can be used as a new electronic payment method instead of traditional plastic cards. The customer creates online Mobile Checkout account and links it with payment processor account (like Amazon Payments). The customer can use the mobile device in order to pay for in-store transactions (grocery, c-store, gas stations) instead of using cash or plastics as well as online transactions or other “customer not present” transactions (phone orders, over the fax, online chat or email). At the checkout time, Mobile Checkout client application on mobile device will display a barcode with one-time token associated with the customer’s Mobile Checkout account. This token will be scanned or entered manually by cashier. Mobile Checkout POS client software will send the token number, merchant identification and transaction data to the server which will match the merchant and mobile device requests and reply to mobile device with a transaction details and prompt for payment authorization. Upon customer approval, the payment information will be forwarded by to the payment processor for authorization. Upon authorization, the result will be sent back to both POS and mobile device. POS will create transaction receipt and send it to the mobile device instead of printing. Mobile Checkout server will accumulate full transaction history and provide this information to both customer and merchant/retailer via Mobile Checkout portal website. There is no additional hardware required for retailer. Minimal changes in POS software code and configuration are required. Mobile Checkout creates flexible interactive payment instrument physically decoupled from the seller site (“brick and mortar” store, ecommerce website, virtual terminal, TV shopping, self-checkout kiosk, vending machine) while both seller and buyer are able to communicate each other in real time. This situation creates unlimited capabilities.

2.2 Additional Features and Services

In addition the main service described above, there are some extra application areas that Mobile Checkout technology allows to introduce.

2.2.1 Gift Cards

Mobile Checkout will maintain individual accounts for each merchant and customer. Those accounts can be used for providing built-in closed loop gift card services for merchant. Customer can purchase virtual gift card at the store or online, and send it to any Mobile Checkout user or redeem it later in store or online. Besides standard promotion benefits of gift cards, the merchant saves on plastic production and shipment expenses as well as account information maintenance cost and processing fees.

2.2.2 Store Credit

Similar to gift cards, Mobile checkout will allow merchant to use customer account in order to issue store credit, instead of paying cash or issuing plastics. Store credit creates more return customers. Merchant saves on plastic production as well as account data maintenance cost and processing fees.

2.2.3 Loyalty Awards (Points)

Mobile Checkout will maintain built-in loyalty program for each individual merchant. Loyalty points will be accumulated by customer account with each purchase and can be redeemed to store credit money associated with particular merchant. This money can be used the same way as gift card or store credit.

2.2.4 Direct Marketing (Promotional Coupons)

Merchant will be able to maintain statistics on customer purchase activity and send virtual promo coupons (specials or discounts) directly to particular customer accounts. Coupons can be reviewed and accepted by customer in order to be used automatically with next purchase.

2.2.5 Virtual Terminal (“customer not present” transactions like phone order)

Mobile Checkout technology will allow secure and fast way of checkout over the phone using Virtual Terminal. The merchant - operator of the Virtual Terminal –communicates with the customer – buyer – over the phone, online chat, fax or email. The customer selects Checkout option on the mobile device and tells the token number to the operator (using phone, online chat, fax or email). The operator opens new transaction screen at Virtual Terminal and enters the token number. Virtual Terminal “connects” to the mobile device and the customer receives the confirmation prompt with details about transaction. Customer checks the payment amount and order details and presses “Pay Now”. Transaction is complete.

The advantages of using Mobile Checkout Virtual Terminal in comparison with regular credit card checkout over the phone or fax:

In addition the main service described above, there are some extra application areas that Mobile Checkout technology allows to introduce.

2.2.1 Gift Cards

Mobile Checkout will maintain individual accounts for each merchant and customer. Those accounts can be used for providing built-in closed loop gift card services for merchant. Customer can purchase virtual gift card at the store or online, and send it to any Mobile Checkout user or redeem it later in store or online. Besides standard promotion benefits of gift cards, the merchant saves on plastic production and shipment expenses as well as account information maintenance cost and processing fees.

2.2.2 Store Credit

Similar to gift cards, Mobile checkout will allow merchant to use customer account in order to issue store credit, instead of paying cash or issuing plastics. Store credit creates more return customers. Merchant saves on plastic production as well as account data maintenance cost and processing fees.

2.2.3 Loyalty Awards (Points)

Mobile Checkout will maintain built-in loyalty program for each individual merchant. Loyalty points will be accumulated by customer account with each purchase and can be redeemed to store credit money associated with particular merchant. This money can be used the same way as gift card or store credit.

2.2.4 Direct Marketing (Promotional Coupons)

Merchant will be able to maintain statistics on customer purchase activity and send virtual promo coupons (specials or discounts) directly to particular customer accounts. Coupons can be reviewed and accepted by customer in order to be used automatically with next purchase.

2.2.5 Virtual Terminal (“customer not present” transactions like phone order)

Mobile Checkout technology will allow secure and fast way of checkout over the phone using Virtual Terminal. The merchant - operator of the Virtual Terminal –communicates with the customer – buyer – over the phone, online chat, fax or email. The customer selects Checkout option on the mobile device and tells the token number to the operator (using phone, online chat, fax or email). The operator opens new transaction screen at Virtual Terminal and enters the token number. Virtual Terminal “connects” to the mobile device and the customer receives the confirmation prompt with details about transaction. Customer checks the payment amount and order details and presses “Pay Now”. Transaction is complete.

The advantages of using Mobile Checkout Virtual Terminal in comparison with regular credit card checkout over the phone or fax:

|

Mobile Checkout Transactions

|

Regular in-store transaction

|

|

Operator can complete the transaction only with buyer permission after the buyer makes sure that transaction details are correct

|

Operator can complete transaction anytime once he/she is obtained the credit card number, even if amount or order information are incorrect – either mistakenly or unintentionally

|

|

Buyer has an ability to check transaction amount and details before confirming the payment on mobile device

|

Buyer has no way to make sure that transaction and order information are entered correctly. In case of error, the merchant will pay additional fees in order to fix the original transaction. In case of fraud – customer may lose the money.

|

|

One time token provided to the merchant is valid for single particular transaction and cannot be reused for other transactions

|

Credit card or bank account numbers can be reused by the merchant for other transactions without customer permission.

|

|

One time token is not representing customer account in any way without the real time context of particular transaction, therefore it would be useless if it is lost or stolen

|

Credit card or bank account number can be stolen during phone conversation (or lost during transmission) and used later for unauthorized purchases (fraud)

|

2.2.6 Self-Checkout

Self-Checkout will utilize special Tags which are banners with Mobile Checkout logo and unique number assigned by Mobile Checkout during Tag registration process. Self-Checkout Tag can be associated with merchandise item or service and located everywhere – in store, at website, self-service kiosk, TV screen, or vending machine. Self-Checkout process is opposite to regular Mobile Checkout. The customer selects Self-Checkout function on mobile device. The Mobile Checkout application prompts for Tag number. The customer enters the number. The Mobile Checkout application communicates with the Mobile Checkout (and merchant’s servers if needed) in order to confirm the item availability, displays the order details and payment amount, and prompts user to confirm the purchase. Upon confirmation and payment authorization, the order is transferred to the merchant’s server for fulfillment. If this is ecommerce or TV shopping, the merchant initiates the order shipment. If this is kiosk or vending machine, the merchant’s application performs the service (for example, vending or printing coupon).

2.2.7 Student Accounts

Mobile checkout account can be used in order to manage spending of other family members, mostly children. As children today use mobile phones extensively, this kind of service will be popular.

2.3 Account Setup

Customer will setup account with Mobile Checkout using Mobile Checkout web application. The information required for setup:

- Mobile phone number

- Email address

- Customer Name

- PIN

- Payment account setup (Amazon Payments, credit cards etc.)

See Security section for more details about new account verification.

Customer will setup account with Mobile Checkout using Mobile Checkout web application. The information required for setup:

- Mobile phone number

- Email address

- Customer Name

- PIN

- Payment account setup (Amazon Payments, credit cards etc.)

See Security section for more details about new account verification.

2.4 Point of Sale Mobile Checkout Flow

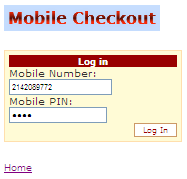

Customer: Launches Mobile Checkout web application on mobile device. Mobile Checkout client application prompts customer to enter mobile number and PIN

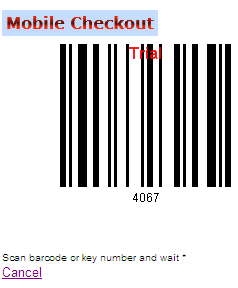

Customer: Logs in and Mobile Checkout application sends request to Mobile Checkout Server which generates one time token number barcode and sends it back to the client application. Mobile Checkout Client application displays the barcode and one time token number

Cashier: Rings items on POS and presses Total button. POS enters to Tender dialog and automatically enables the scanner.

Cashier: scans or keys the barcode from mobile device display (Note: as an extra feature, the barcode can be scanned/entered at any time during transaction and not necessarily at the end of transaction. Scanning the barcode at the beginning of transaction will save transaction processing time since cashier can scan items and customer can review and select payment information on mobile device at the same time). POS sends barcode, merchant identification and transaction data to the Mobile Checkout Server.

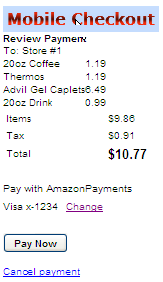

Mobile Checkout application: displays transaction details and payment amount, and prompts the customer to pay with default payment method associated with the account

Cashier: scans or keys the barcode from mobile device display (Note: as an extra feature, the barcode can be scanned/entered at any time during transaction and not necessarily at the end of transaction. Scanning the barcode at the beginning of transaction will save transaction processing time since cashier can scan items and customer can review and select payment information on mobile device at the same time). POS sends barcode, merchant identification and transaction data to the Mobile Checkout Server.

Mobile Checkout application: displays transaction details and payment amount, and prompts the customer to pay with default payment method associated with the account

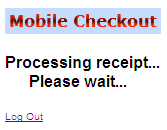

Customer: approves the payment and Mobile Checkout application sends data to the server. Upon receiving approval from the authorizer, Mobile Checkout Server returns an approval response to both POS and mobile devices

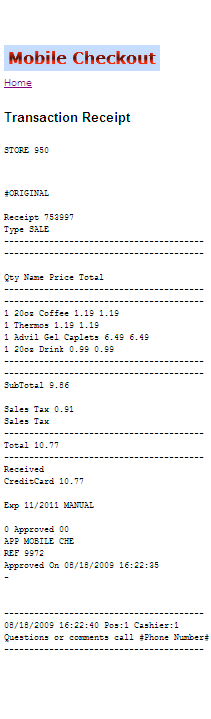

Point of Sale: closes the transaction and sends the receipt to the mobile device along with coupons if available. Mobile device automatically displays the transaction receipt as soon as it is received from the server.

2.5 Security

2.5.1 Transaction processing

· During in store transaction, both merchant’s POS software and customer’s mobile phone operate with one-time temporary token number randomly generated by Mobile Checkout Server for each new transaction request. Such number does not represent directly any customer account information and cannot be used for further payments or without customer authorization. Token number becomes invalid as soon as 1) transaction is complete or 2) customer presses Cancel and leaves the Checkout screen or 3) Checkout screen times out after predefined time interval (few minutes).

· Actual customer’s financial information (credit card or bank account numbers) is never sent to/accessed by merchant’s POS software or customer’s mobile device. Instead, it is being securely stored and processed by Mobile Checkout Server or/and payment processor. Therefore, in case the mobile device is lost or stolen, or POS payment history data is compromised, the actual customer account data will never be exposed.

· Customer PIN is never sent through merchant’s in store software which makes it protected in case the POS store software or merchant’s corporate network are compromised using scam techniques (installing Trojan application in the merchant network, installing additional pinpad keyboard or hidden camera focused on pinpad keyboard etc.).

· Since there is no need to enter PIN on unattended terminal (only one-time temporary id number should be entered), there is no risk of PIN scam which is usually done by installing additional pinpad keyboard or hidden camera focused on pinpad keyboard. The one time temporary token is discarded immediately after transaction is finished or after several minutes if transaction is cancelled. The Mobile Checkout PIN number can be keyed on mobile device when the consumer is still in the car even before transaction is initiated.

· The PIN number transmission will be protected by SSL. Public key encryption and DUKPT can be used as additional protection level when necessary.

2.5.2 Possible extra security measures

The Mobile Checkout usage can be limited to certain geographical area by using built in GPS or mobile triangulation. This is extra third authentication factor – “somewhere you are” - in addition to first “something you have” (mobile device) and second “something you know” (PIN) factors. Also, payment terminal can verify that device is actually present at transaction time by comparing the site geographical location with the current location of the mobile device.

2.5.3 New account registration

The authenticity of the information provided by user in order to open new account (email address, cell phone number, credit card account number, bank account number) can be verified automatically at time of online registration.

Email address can be verified by sending an automatic email with verification code. New account can be activated only after user enters the activation code.

Cell phone number can be verified by sending an automatic SMS message with verification code. New account can be activated only after user enters the activation code.

Credit card account can be verified by sending an automatic authorization to credit card account with small randomly generated amount. User should confirm his identity with the bank-issuer of the credit card in order to obtain the amount of temporary authorization. It can be done by using online banking or calling the customer service. New account can be activated only after user enters the amount of the authorization. Temporary authorization then will be automatically cancelled.

Bank account can be verified by sending an automatic deposit to bank account with small randomly generated amount. User should confirm his identity with the bank in order to obtain the amount of the deposit. It can be done by using online banking or calling the customer service. New account can be activated only after user enters the amount of the deposit. Deposit then will be automatically cancelled.

Copyright © 2009 by Slava Gomzin

|

|

|