Updated with more details about tokenization implementation on October 3, 2014.

Apple Pay could be a big deal for the payment industry because — besides all the other business and marketing considerations — it looks pretty attractive from a security point of view. Here’s why:

1. Two-factor authentication on every transaction — “something you have” (iPhone) + “something you are” (fingerprint). The security level is higher than Chip & Signature — “something you have” (your card) — and is similar to chip and PIN — your card as “something you have” plus PIN as “something you know”. However, the biometric fingerprint is usually stronger than 4-digit PIN, which can be guessed or stolen through skimming. Therefore, the Apple Pay’s cardholder authentication is stronger than even chip and PIN, meaning that there are fewer fraud risks for merchants, issuers, card brands, and service providers.

2. Using tokenization technology, however it is implemented or called, means that merchants are not exposed to card data in clear text, which in turn means that the merchant’s payment acceptance systems do not have to be PCI compliant anymore. Unfortunately, this does not help traditional retailers much, since their systems (POS + payment terminal) must be PCI compliant anyway in order to process regular payment cards. However, it opens the door for a new way of payment acceptance — virtually, any device with NFC chip (for example, a business or even consumer grade laptop or tablet) can “legally” accept Apple Pay and not worry about PCI compliance. Of course, this statement requires some proof, that’s why I am looking for more details about Apple Pay’s tokenization system.

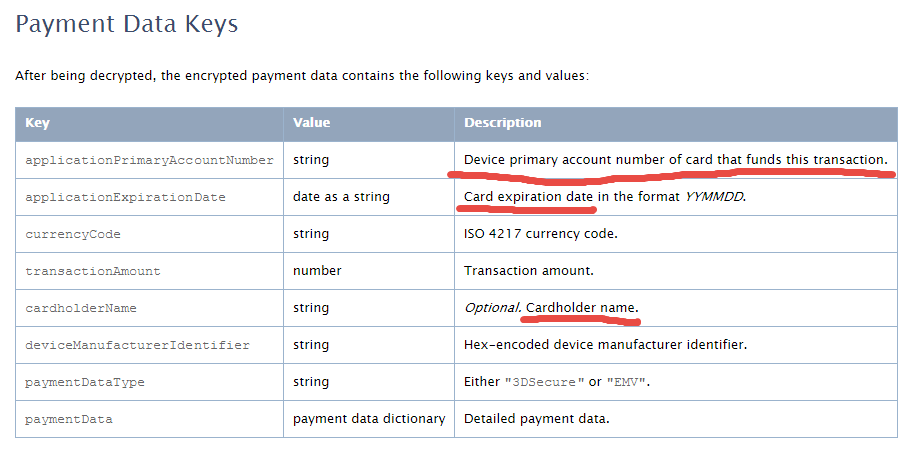

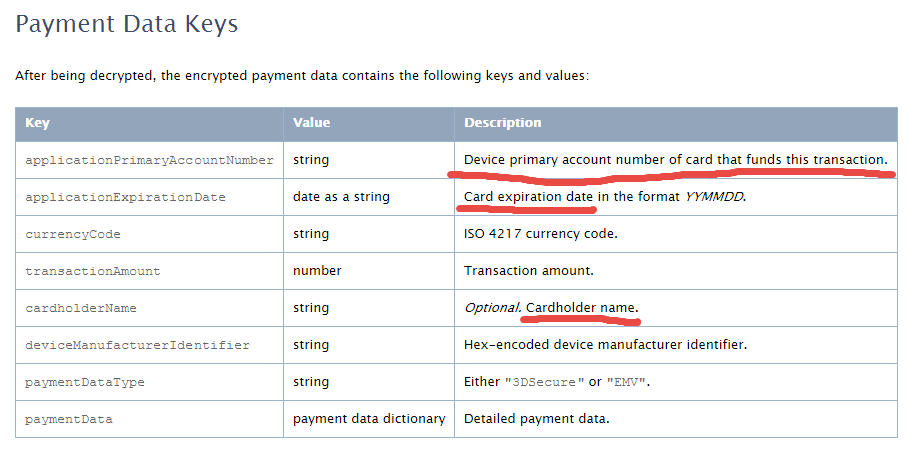

The security of Apple Pay’s tokenization system is still questionable. Based on information I found so far, the payment token (at least the one used for in-app purchases, as the company has not released enough technical details about in-store purchases) contains encrypted cardholder data — primary account number, expiration date, and cardholder name — which in my opinion reduces the Apple Pay security score a bit.

Below is the fragment of Payment Token Format Reference from the PassKit reference.

There is another statement from the same Getting Started with Apple Pay document that proves that the payment tokens (and therefore iPhone’s secure element) contain encrypted card data: “The alternative is to provide your own server-side solution to receive payments from your app, decrypt payment tokens and interface with the payment provider.”

Note that this statement specifically targets the in-app purchases, and I am not sure whether the same token is used for in-store purchases or whether the in-store token, even if it has the same format, in fact contains the card data. In any case, it looks like at least the in-app purchase token does contain the encrypted cardholder information.

This fact contradicts Apple’s claim that no card data would be stored on the iPhone device. Usually, “no card data” means that there is no cardholder data at all, even in encrypted form. Some tokenization implementations, for example, use randomly generated tokens that cannot be reversed back to the original PAN (primary account number).

How difficult is to trick the Apple Pay system in order to decrypt the payment token and retrieve the original card data? That’s still an open question, but I am sure hackers have started thinking about it already. Another question is whether Apple is using the same token (or the same data inside the token) for in-store purchases, i.e. whether the in-store token contains the same card data elements as the in-app token.

I hope Apple will release more technical details about its “in-store” tokenization technology to the public so security experts can review it, calculate the risks, and determine the level of security.

Update on tokenization implementation, October 3:

Apparently, Apple Pay uses "network tokenization" - a technology implemented by payment brands (Visa, MasterCard, Amex) and supposedly based on common "EMV tokenization" approach (the spec was released by EMVCo in March 2014). There is a confirmation at least from Visa for the first part. However, unfortunately, there is no official confirmation for this information from Apple as well as there are no technical details available about Visa Token Service or other brands' tokenization implementations (for example, whether they are compliant with EMVCo spec or not) . Anyway, such implementation scheme, with connection between "network tokenization" (like Visa Token Service) and "EMVCo tokenization", would make sense. Let's assume this is true so we could imagine how it works before we get the actual details.

"Network tokenization" would address some concerns expressed in my original article and provide answers to some questions. For example, it explains the "device primary account number" field in the picture above. In the "network tokenization" scheme, the token looks the same as the original PAN (19 digits starting from the payment brand's identification prefix such as "4" for Visa) . "Device PAN" probably means that the token is encoded in this field rather than the original PAN.

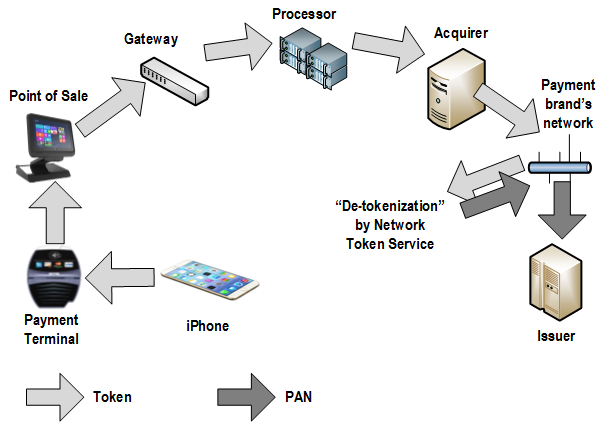

"EMV tokenization" uses the format-preserving token which looks like regular PAN but has a special BIN range dedicated by the payment brands for tokens. Thus, the fact that the token is used instead of the original PAN is transparent for existing merchant and payment processing systems. "De-tokenization" is done by payment network (Visa, MC, Amex, etc.) - after transaction authorization request passes the gateway, processor, and acquirer, but before it hits the issuer. This is the first main difference of EMV tokenization from "classic" tokenization implemented by payment gateways and processors, where transaction is "de-tokenized" before it even reaches the acquirer and the network.

And third difference: since Apple Pay apparently uses EMV Contactless protocol for communicating the data between the iPhone device and merchant's payment terminal during transaction, the token is always accompanied by the cryptogram - a piece of additional dynamic encrypted data which changes for each transaction and allows the payment terminal and the tokenization system to authenticate the cardholder and validate the token. Hopefully, the token is invalid without the cryptogram, otherwise, it could potentially be used just as regular PAN for any transaction.

Finally, some good news for consumers and merchants: there is an indication that "Apple Pay like" systems can be implemented by other mobile payment providers. Here is important quote from Visa website which is worth mentioning:

Now you can offer consumers a broad range of simple digital payment options, while protecting their sensitive information from fraud. Whether you want to enable mobile payments with Apple Pay or Android devices, create a frictionless e-commerce experience with Visa Checkout, or securely maintain cards on file, Visa Token Service provides the unifying platform.

Although all these assumptions sound reasonable, many of them still require official confirmation and additional explanation which are highly anticipated from Apple.

RSS Feed

RSS Feed